How to Use Undeposited Funds in QuickBooks Online

Did you connect your Clio account as a bank feds or through app integration on our QuickBooks Online App menu? That way, we’ll be able to give ways to match your Clio payment to your QuickBooks Online records. That’s why you don’t need to combine transactions or use Undeposited Funds because QuickBooks already has the information from your bank. All you have to do is categorize your downloaded transactions. Otherwise, you run the risk of either understating or overstating your income, both of which will have tax implications. Continue entering payments received from your customers until all payments have been entered.

- If there’s anything else that I can help you with aside from managing your bank transactions or any banking-related, please let me know in the comments below.

- Choose your customer from the drop-down menu and their open invoice will automatically show up on the list.

- Getting rid of undeposited funds in QuickBooks involves a meticulous process of clearing and reconciling pending payments to ensure accurate financial records and transparency.

- It’s possible that you’ve seen it many times without knowing much about it, or when you should use it.

- To resolve this issue, it is essential to regularly review bank and credit card statements, categorize transactions accurately, and use payment matching to identify and merge duplicate entries.

What’s the Undeposited Funds account?

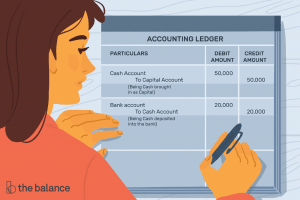

Clearing out undeposited funds in QuickBooks Online is essential to ensure accurate financial records and transparency, requiring meticulous attention to pending payments and deposits. Verify that the deposit amounts in QuickBooks match those in your bank statements. Once the deposits are accurately recorded, the undeposited funds will be cleared, contributing to the overall accuracy of your financial records. To begin, access the Banking menu in QuickBooks and select Make Deposits. Then, locate the undeposited funds account and ensure that all payments are properly matched and deposited into the appropriate bank account. It’s important to review each transaction carefully to avoid any discrepancies.

Payments processed with QuickBooks Payments:

So be sure to double-check that you properly complete the bank reconciliation to clear the balance. The special account enables you to combine multiple transactions into one record in the how to create a business budget same way your bank has combined all the transactions into one record. When you put money in the bank, you often deposit several payments at once. For example, let’s say you deposit five US $100 checks from different customers into your real-life checking account.

What’s the Undeposited Funds Account?

This will help catch errors and discrepancies and ensure a more efficient bank reconciliation. To do this, click Reports in the left menu bar and then select Deposit detail under the Sales and customers section, as shown below. It requires you to do an additional step in the form of multiple entries for each deposit (one to the undeposited funds account and the other to the right account). It is, however, useful for businesses that frequently get paid by check or cash and physically deposit the money to the bank instead of using mobile check deposits. Clearing out undeposited funds in QuickBooks involves specific procedures and steps to ensure accurate reconciliation of pending payments and deposits within the software. Clearing undeposited funds in QuickBooks Desktop involves specific procedures and steps to ensure accurate reconciliation of pending payments and deposits within the desktop travel agency accounting software.

Mark Calatrava is an accounting expert for Fit Small Business. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. If you need to delete a bank deposit, click the deposit or amount field in the Deposit Detail report and then click More at the lower part of the screen and then select Delete as shown below.

These funds serve as a temporary holding account and allow for grouping multiple payments together before depositing them into the designated bank account. This process streamlines the bank reconciliation process and ensures that the company’s financial records accurately reflect the transactions. Getting rid of undeposited funds in QuickBooks involves a meticulous process of clearing and reconciling pending payments to ensure accurate financial records and transparency.

You have to think of receiving payments in QuickBooks as you sitting at the office recording your various customer payments against an invoice or invoices. When you receive a payment against a customer invoice you are increasing undeposited funds. The udeposited funds account exists because you have not told QuickBooks what bank account you would like to deposit the funds into.

Learn How We Can Impact Your Business Growth

We’ll also cover how to clear undeposited funds in QuickBooks Desktop and how to turn off undeposited funds in QuickBooks Online. Head over to the plus sign icon + and select Receive Payment. Choose your customer from the drop-down menu and their open invoice will automatically show up on the list.

You received the check on the last day of the year, which happened to be a Saturday. In simpler terms, it’s a holding account for the money you have received and intend to deposit, but you haven’t deposited yet. This is different from petty cash or your cash register till, which is cash you have on hand but don’t intend to deposit. As you can see in the image above, QuickBooks Online instructs you to use the Cash On Hand account instead of the Undeposited Funds account for petty cash. going concern tips for auditors during the pandemic If your bank records a single payment as its own deposit, you don’t need to combine it with others in QuickBooks.